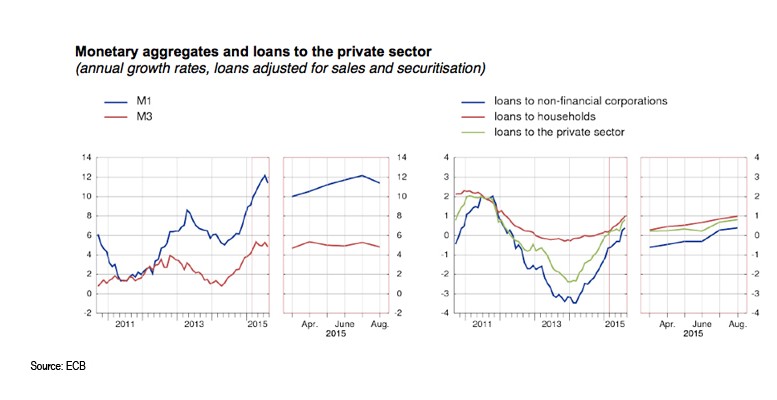

Even if money supply growth in the eurozone slowed by 0.5% to 4.8% in August, credit to households increased by 1% to 1.4%. In particular, mortgage loans rose 1.6% compared to July.

Furthermore, credit to non-financial companies rebounded to 0.4% on a year-on-year basis. AFI analysts point out that since March, money stock in the euro area has continued to grow over 4.5%, the European Central Bank’s benchmark level.

“This shows that the central bank’s balance expansion is allowing eurozone financial conditions to relax, an essential requirement for ensuring the economic recovery keeps moving,” AFI experts said.

Private lending and money supply growth are both measured by the ECB.