Now that the U.S. stimulus program has started the countdown- while Europe has not even considered to implement a similar action- it seems reasonable to remind pros and cons of an strategy that has been scorned by austerity inclined leaders as well as disesteemed by those in favour of an expansive monetary policy, for instance Market Monetarists.

Negative comments based on reasons of principle are self- evident: fans of austerity and rest of hysterical had forecast that hyperinflation would have come at this time present year, that Quantitive Easing meant a currency “debasement” and so on. Inflation is lowest than ever. There is not more to say.

However, criticism from monetarists have been continuous due to the hypothetical insufficiency of QE. It was in the right direction but fall short, it should have been big enough to reach a certain nominal GDP or other nominal optional objectives. These attacks lacked of a serious fault: they did not even mean to quantify in any way how much it was needed to achieve their proposals.

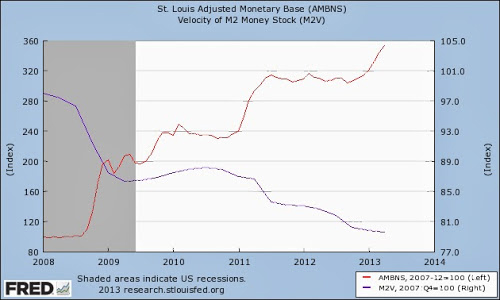

In the picture that illustrates this article the monetary base (blue line) indicates the increasing QE’s inefficiency to awaken the dormant monetary supply (red line). There is an urgent need to calculate an amount because normalising M2 would seemingly demand a monetary supply beyond 300% injected since the crisis started.

Such an apathy for spending money, despite cheap prices that Fed offered, has been seen just a few times. It is difficult to deny this implies a first- class monetary and financial collision, and the fact of diverting attention from structural problems, especially inside labour market, represents an unheard ineptitude. It is possible to create as many models as one can desire, but all of them get nullified by the picture’s figures: do not tell me that you are to normalize monetary variables by cutting wages!

Why people did not madly embarked on investing or spending free money on any thing? Monetarists give an explanation: expectations on future prices are so high that people find more reasonable to maintain liquidity, although this option may not be profitable. Keynes gives another reason: the interest rate that would enable profitability is too much low for the Fed since it cannot move from zero interest (it is the zero lower bound or ZLB).

Monetarists say that ZLB is not relevant because investments costs can always be reduced by a positive inflation, which could bring a negative real interest rate. To convince people for spending money is not only a question of monetary supply measures.

Anyway, the picture above makes clear that some exceptional thing is happening. The monetary policy has worked in the countries which developed it unashamed. US, UK, Japan or even Switzerland have reactivated their economies and diminished wealth imbalances, at least in comparison with the euro zone. However it is also truth that its efficiency, according to the demanded amounts, has performed poorly. In other words, the effects of monetary supply are not mechanical. Firstly, wealth balances are not considered very frequently and they need some logic time frame to reach normalisation. Furthermore, there are collective mental states, the Keynesian animal spirits. Nobody has seen them, but they do exist seemingly.

Be the first to comment on "QE Effects: Shut Your Eyes to The Evidence"