Holders of Bankia preferred stock and subordinated debt: let’s breathe!

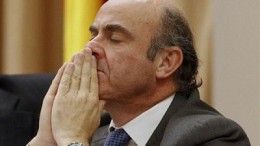

Spanish Minister of Economy Luis de Guindos gave some hope on Tuesday to the 80,000 Bankia customers stuck on preferred shares and subordinated debt: an arbitration process will be in place in those cases where there had been bad practice. Two other nationalized banks (Novagalicia Banco and Catalunya Banc) are using the same procedure so their clients will be able to get back at least 60% of their money.