Indicators for the real estate market show a significant recovery in activity in the sector, following the standstill during the state of alarm. On the demand side, home sales recovered well in July and increased by 20% month-on-month, although in cumulative terms for the year to date there is still a year-on-year decline of 25.8%. On the supply side, the construction sector has also quickly restarted its activity. In August, cement consumption was only 2.1% below the level of August last year, with a notable recovery from the 50% fall registered in April. As reported by Caixabank Research, “despite the revival of activity, the main housing price indices have already begun to show the impact of the crisis on the market.

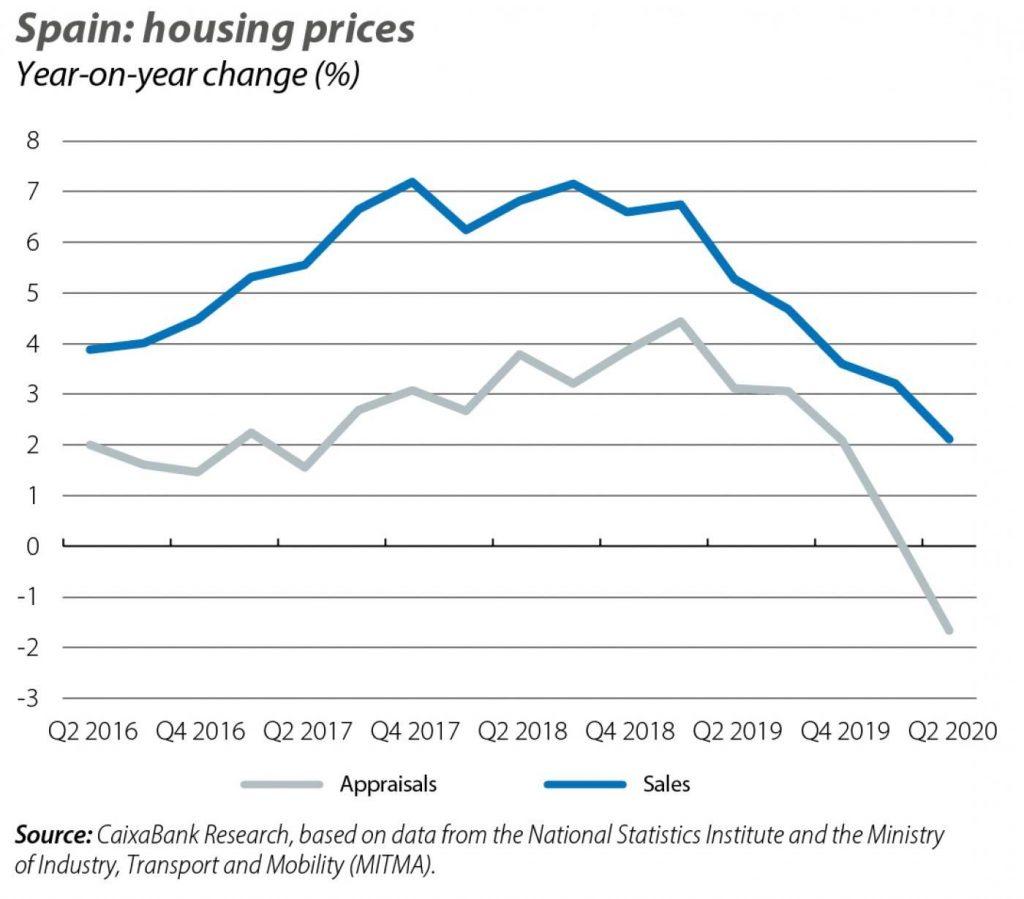

According to the valuation data, the decline in housing prices accelerated in Q2 2020, with a 1.8% quarter-on-quarter fall (–0.8% in Q1 2020). In year-on-year terms, the price fell for the first time since Q1 2015 (–1.7% year-on-year). According to the data from property sales, meanwhile, prices remained virtually stagnant in quarter-on-quarter terms (+0.1%) and slightly up in year-on-year terms (+2.1%).

Over the coming quarters, CaixaBank Research expects the decline in housing prices to continue.

“Nevertheless, it is important to emphasise that the sector was in a much better situation prior to the COVID-19 crisis than it had been prior to the previous recession, which gives us some confidence in its ability to recover.”