Multiple rounds of quantitative easing (QE) and liquidity injections resulted in more than a four-fold increase in the aggregate G4 central bank balance sheet in the last decade. Balance sheet expansion arguably lowered long-end yields across developed markets and boosted risk assets, both by crowding investors out of safe assets and by signalling that policy would remain very accommodative for an extended period.

This experience has many worried about a “quantitative tightening ” trade, in which substantially all asset classes would simultaneously experience large losses. Here analysts at BoAML argue that those worries can be put off for another day.

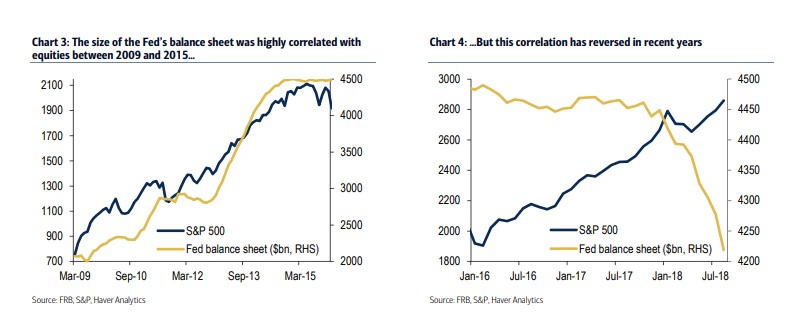

First, Chart 3 is likely an example of spurious correlation—two series that move together where there is little, if any, causal relationship. Anything that grew during the economic expansion from 2009 to 2015 was highly correlated with the stock market.

Moreover, it never made sense to us that the bond market would rally when QE programs were announced, while the equity market (allegedly) only rallied as the Fed did the purchases. Why would equity investors ignore the announcement and only react as the expected Fed buying happened? Chart 4 shows that the correlation between the balance sheet and the stock market has been negative for the last few years.

Second, in BoAML’s view, central bank balance sheet expansion has had a relatively modest impact on markets. In a piece for the Monetary Policy Forum they showed that Fed balance sheet news had a relatively small impact on bond yields; economic news and events in Europe moved the US bond market much more than QE. In follow-up work, anaysts showed that the same results hold for the term premium.

Further, the actual expansion of the balance sheet was only one of three stimulative elements of unconventional policy. Also important was the confidence effects of a central bank “doing whatever it takes” and the fact that extended QE signalled that rate hikes were a long way off.

Third, somewhat to surprise of experts at the firm, the recent experience suggests even weaker balance sheet effects than they expected.

The bond market seems to have had very little response to both the Fed signalling QT and the Fed implementing QT. Term premiums remain remarkably low.

Finally, as BoAML have shown above, the actual amount of QT will probably be relatively small. All of the major central banks are likely to maintain very large balance sheets for the foreseeable future and even the Fed is expected to stop shrinking its balance sheet next year and then let it grow in line with the economy thereafter. Overall, the aggregate G4 balance sheet is projected to decline by only 4% by the end of 2020. No doubt other policy tools are helping cushion the exit ramp. The Fed is hiking at half the normal exit speed. The ECB is promising to keep rates low for longer. And the BoJ is sustaining yield curve control for the indefinite future. They conclude:

We are worried about a lot of things—trade wars and oil sanctions come to mind—but we are not worried about quantitative tightening.