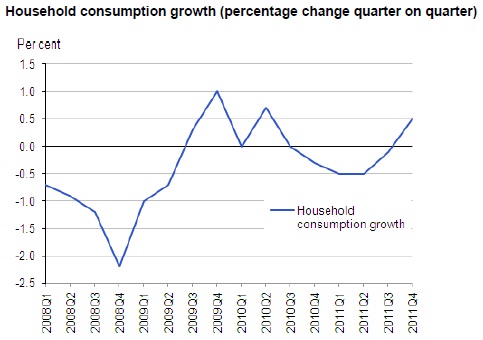

LONDON | The second estimate of GDP growth in the fourth quarter of 2011 confirmed the forecast of a contraction of 0.2pc, according to the latest UK Statistical Bulletin. However, the breakdown showed positive contributions from household expenditure (following four consecutive quarterly falls) and from net trade, with negative contributions from inventories and business investment.

The British government said this presents a more positive picture of the expenditure side of the economy than in the previous quarter, when growth was solely attributable to the rebuilding of inventories.

But the labour market continues to be subdued with employment rising only slowly in the final quarter of the year. Consumer price inflation fell sharply in January, as expected, as the impact of the January 2011 rise in the rate of VAT fell out of the annual figures. The drop in headline measures of inflation masked a jump in the rate of CPI inflation excluding indirect taxes (CPIY) in January which has barely fallen back since the inflation peak in September 2011.

There is another curious piece of data that exposes the fact that domestic demand has not yet recovered and households do not feel confident. Research by the Financial Services Compensation Scheme (FSCS) has found that over £5.6 billion in cash is left in people’s homes. Excluding money in their wallets, the average amount kept at home is just under £218. This means that across the country, the UK’s 26 million households have £5,665,920,000 which is unprotected.

While 33% of those questioned say they have less than £20 at home, 3% said they had more than £1,000 at home. This money will be largely unprotected in the event of house damage, with even the top insurance policies only covering up to around £1,000. Even if everyone surveyed had the top policy, this would mean a total of almost £170 million is not protected.

The large sums kept at home could be attributed to the fact that over one in ten (13% of those questioned, the same as last year) believe their money is safer at home than in a bank or building society. Only 64% disagree with this statement.

“It is encouraging that people are keeping less money at home than they did in 2011. In part this may be because people have less spare cash than they did 12 months ago,” Mark Neale, Chief Executive of the FSCS, said.

There were 26 million households in the UK in 2010 (the most recent figures available). Assuming each person questioned was talking about the total money in the household, this gives a total of £5,665,920,000. The figure 12 months ago, based on 24.9 million households in the UK (figure from 2006), was £7,017,318,000.

Be the first to comment on "Billions of sterling pounds under the mattress"