Bruno Cavalier (ODDO BHF) | In a few weeks’ time, Angela Merkel will cease to be Chancellor, a position she has held since 2005. At the helm of the EU’s leading economy, she has lived through the Great Financial Crisis (2008), the Eurozone sovereign debt crises (2010-2015), the Fukushima catastrophe (2011), the annexation of Crimea by the Russian Federation (2014), the migrant crisis (2015), Brexit (2016-2019) and the pandemic (2020-2021), all of which have influenced political and economic decisions in Germany and Europe. Polls show there is a tie between the three main contenders to succeed her. Here is an update on the economic situation.

Angela Merkel has been Chancellor of Germany for four consecutive terms, i.e. more than 15 years, second only to Otto von Bismarck (>22 years) and her mentor Helmut Kohl (>16 years). During this period, she has had relations with four US presidents, four French presidents, five British prime ministers, eight Italian prime ministers, three presidents of the ECB, etc. On the economic front, it is generally accepted that her performance in European affairs proportioned stability during several tense moments, such as the Italian crisis of 2011 and the Greek crisis of 2015. But this stability was often paid for with a certain sluggishness in decision-making because the required actions went against monetary and fiscal orthodoxy, which is why German public opinion and the CDU’s electoral base opposed it. Instead, during the pandemic, the German chancellor pushed for a rapid fiscal response, which resulted in the EU stimulus package. It is rather insufficient to say that her withdrawal from political life leaves a vacuum in Germany and on the international scene.

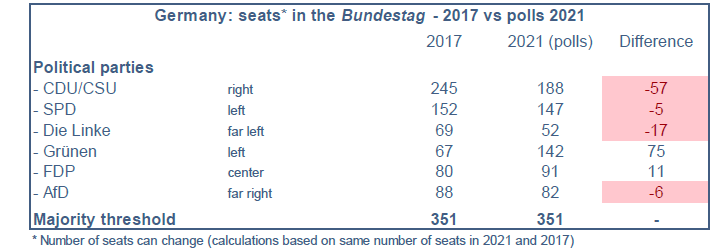

Politics – With only a few weeks to go before the parliamentary elections on September 26, the outcome looks very doubtful. The three main governing parties (CDU/CSU, SPD, Grünen) and their respective candidates are virtually tied in the latest polls, if the margin of error is taken into account, at around 20% of voting intentions; but their recent trends differ, with the SPD up, the CDU/CSU down and the Greens almost stable. The liberal FDP, at around 12%, benefits from the CDU’s falling voting intentions. The Eurosceptic AfD party, the third largest group in the Bundestag in terms of number of seats, has stabilized at over 10%. The far left exceeds the 5% threshold needed to win seats. Based on the latest polls – which is obviously not a forecast – the composition of the next German Parliament would be as follows (table).

So far, the main improvement in seats appears to be for the Greens. The CDU/CSU alliance, despite a drop in the number of seats, would remain the largest party in the Bundestag. Since the previous elections in 2017, policies in Europe have sparked a lot of debate in Germany (ad hominem attacks on Mario Draghi, complaints filed with the Constitutional Court against the ECB’s asset purchase programs, criticism of the EU stimulus package benefiting southern countries). Still, the AfD does not seem to have broadened its Euroskeptic public. Ultimately, as in other Western democracies, political fragmentation is on the rise, while the electoral system relies heavily on proportional representation. The pandemic may also affect turnout and results (postal voting). All this points to a long road ahead for the formation of the next coalition. Based on the above projections, the most likely coalitions involve three parties (table), which translates into agreements on the distribution of ministerial posts and the elaboration of the government programme. In short, Germany will continue to be governed from the center, with a firm commitment to the European project, but for the first time in fifteen years, the center of gravity could shift from the center-right to the center-left. If the Greens are part of the coalition, it would be the first time since the terms in office of Gerhard Schröder (1998-2005).

Budgets – At the macro level, one of the main consequences of the elections is fiscal policy. None of the three major parties proposes to challenge fiscal regulations, some of which are set out in the Constitution. Even so, this does not imply an immediate tightening with a view to returning to a surplus situation. On the expenditure side, there is no reason to depart significantly from recent trends. In this regard, it is worth correcting the stereotype of a spending-reluctant Germany. Between 2011 and 2019, public spending (excluding interests) increased by 3.6% per year, much higher than in the rest of the Eurozone (1.7%). In particular, public investment spending grew rapidly, at a rate of 4.0% per year, bringing the ratio from 1.9% of GDP in 2005, at the start of the Merkel era, to 2.8% today (the European average is 3.4%). The need to adapt the German economy to the new environmental landscape justifies further investments, according to the Commission’s convictions. There is broad consensus on this point.

The differences between the parties are most pronounced on taxation and regulation. The conservatives do not expect any major changes. The SPD supports a wealth tax with a basic rate of 1%, a reform of inheritance tax and the taxation of couples, the creation of a financial tax, in return for which taxes for lower-income households would be reduced. The Greens, in agreement with the SPD on this point, plan to increase the minimum wage to 12 euros per hour, compared to the current 9.5 euros. It should be noted that the implementation of any of these proposals will depend on the type of coalition that is formed and the compromises between its participants. In general, it seems that the idea of having a more active fiscal policy, i.e. less exclusively driven by tax rules, has gained traction.

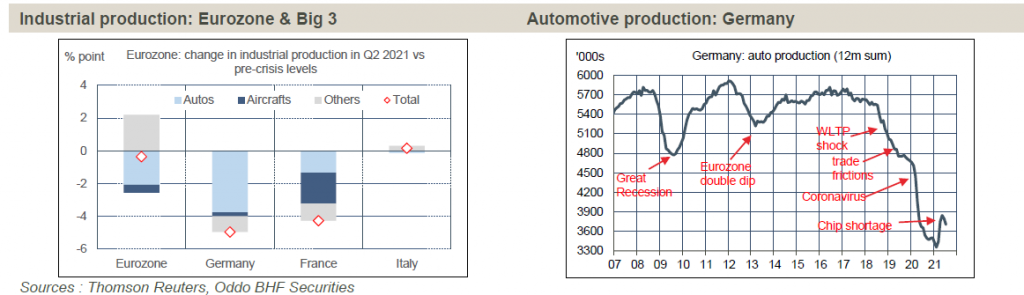

Economy – The next coalition will inherit an economy that has not fully recovered from the coronavirus crisis. At the start of the pandemic, Germany was able to limit the effects more than its neighboring countries by adopting less severe containment measures. At the time, the Chancellor was praised for her handling of the first wave of contagions. As a result, the rebound in activity that automatically followed when the restrictions were lifted was weaker. Germany’s good performance has not been sustained. Successive waves of contagions brought new restrictions in early 2021, delaying the recovery. In Q2 2021, German real GDP was 3.3 points below its pre-pandemic level (Q4 2019), the same gap as in France and about the same as in Italy (3.8 points). Although global demand for goods is remarkably robust, which should have benefited an industrial powerhouse like Germany, supply constraints have been and remain predominant. The problem is so acute that industrial production is currently more depressed in Germany than in the rest of Europe. It is 5 points below its pre-crisis level, while the gap has almost been closed at the Eurozone level thanks to gains in the production of computer equipment and pharmaceuticals (lhs charts).

Germany clearly suffers from its overexposure to the automotive industry, which is 25 points below normal. The obvious cause is the shortage of electronic components, a global problem. It should be noted that the decline in automotive activity in Germany did not start with the pandemic. The past three years have seen a succession of negative impacts, at first glance temporary, in the form of new environmental regulations, trade frictions and now the shortage of semiconductor chips. Ultimately, this radically alters the contribution of this sector to total activity (graph rhs).

Clearly, this does not imply the deindustrialization of the German economy, but it is true that the labor cost advantage that the country had when the euro was created and for some fifteen years has virtually disappeared. The level of unit labor costs is now only marginally lower in Germany than in the rest of the euro zone. In the long term, this may reduce the momentum of industry and shift the production structure more towards the local market and less towards exports.

In the short term, the recovery will continue to be limited by the weakness of the automotive sector, but the other service sectors will more than compensate for this disadvantage. Despite some catching up/moderation, the latest business climate indices from the Ifo and PMI surveys forecast an acceleration of GDP growth in the third quarter (after +1.6% quarter-on-quarter in the second), linked to the continuation of the recovery in services consumption. In the hospitality sector, for example, activity was at 40% of normal levels in Q2; if it were to return to 80% in Q3, which is not out of reach following the end of restrictions, this would add 0.7 points of growth. With a labour market showing solid hiring intentions, the pre-pandemic level of activity should be exceeded before end-2021. In 2022, the German economy is expected to benefit from the gradual disappearance of production bottlenecks (the upturn in automobile production is delayed). As a result, analysts expect, unlike other developed economies, stronger growth in 2022 than in 2021, to the order of 3.5% and 5% respectively.