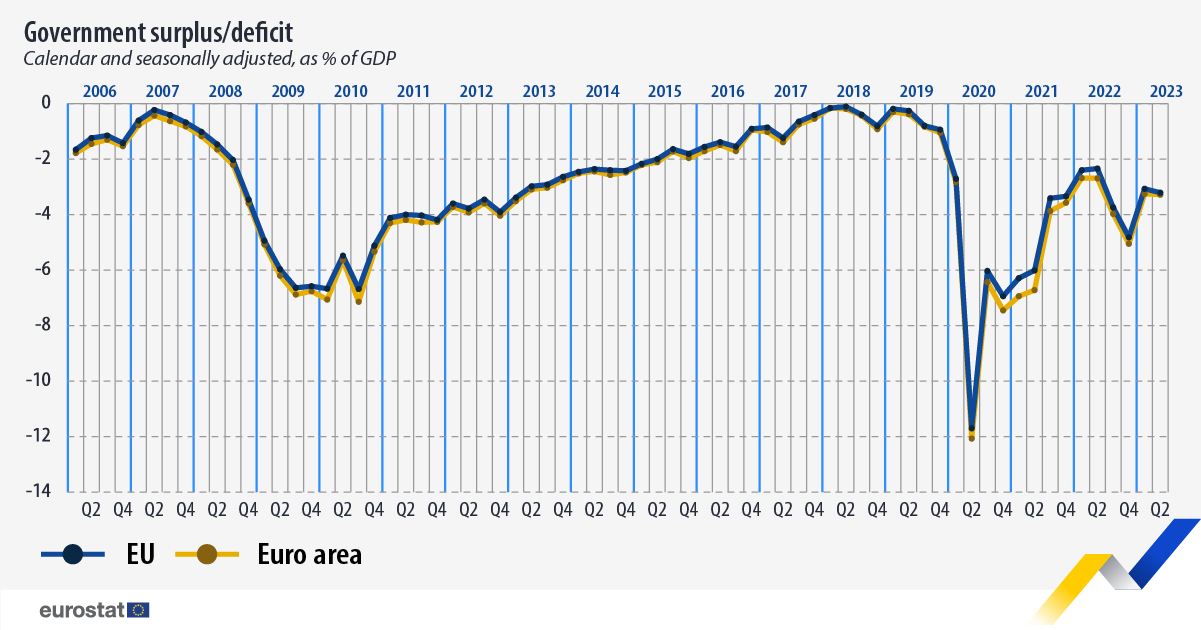

CdM| In the second quarter, public debt in the euro area fell to 90.3% of GDP compared with the previous quarter, while the government deficit remained at 3.3% of GDP, according to data from Eurostat, the EU’s statistical office.

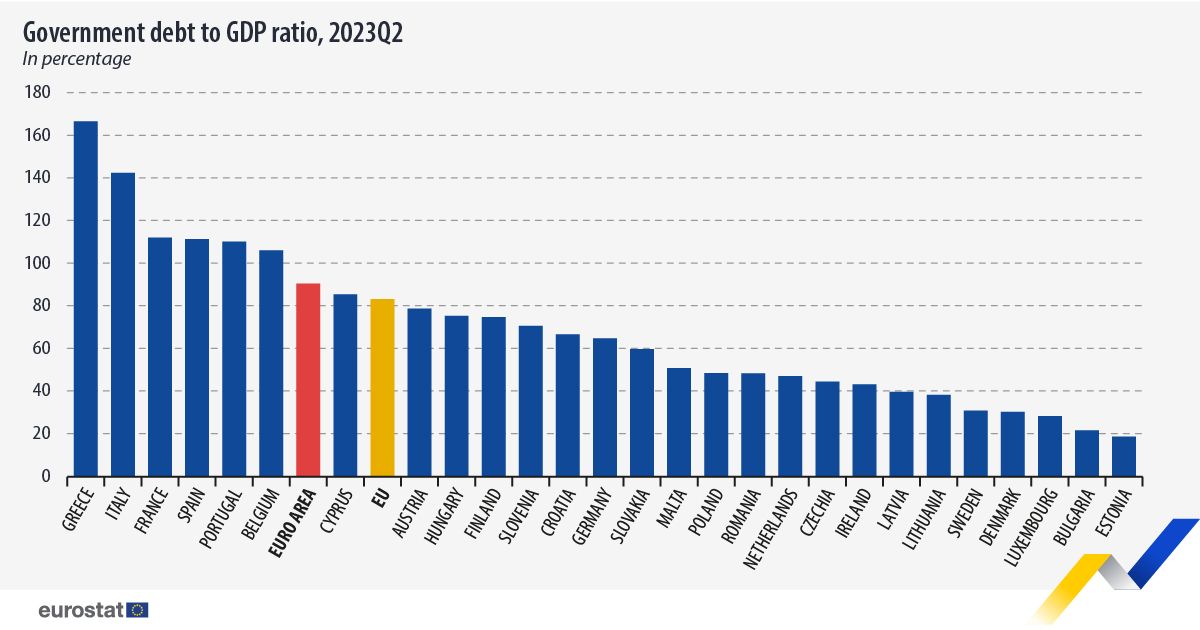

In the EU, the government debt ratio also declined, from 83.4% to 83.1% of GDP. For both the euro area and the EU, the decline in the government debt-to-GDP ratio is due to the fact that an increase in GDP in absolute terms outweighed the increase in government debt.

Compared with the second quarter of last year, the government debt-to-GDP ratio also declined in both the euro area (from 93.5% to 90.3%) and the EU (from 85.9% to 83.1%).

At the end of the second quarter of 2023, debt securities accounted for 83.4% of euro area debt and 82.9% of EU general government debt.

Loans accounted for 13.8% and 14.3% respectively, and cash and deposits accounted for 2.8% of euro area and 2.7% of EU government debt.

The highest government debt-to-GDP ratios at the end of the second quarter were recorded in Greece (166.5%), Italy (142.4%), France (111.9%), Spain (111.2%), Portugal (110.1%) and Belgium (106.0%). By contrast, the lowest were in Estonia (18.5%), Bulgaria (21.5%), Luxembourg (28.2%), Denmark (30.2%) and Sweden (30.7%).

The euro area deficit remained stable compared with the first quarter of 2023 at 3.3% of GDP. In the EU, it increased slightly to 3.2% of GDP from 3.1% in the first quarter.

Eurostat stresses that measures to alleviate the impact of high energy prices continued to have a strong impact on government balances in the second half of 2022 and in the first and second quarters of 2023, with most Member States continuing to record a government deficit.