ASE Group | Until the 17th, the daily price of the Spanish wholesale market (POOL) in April stood at €5.40/MWh, the lowest since records have been kept for such a long period. Grupo ASE analysts highlight that in almost 50% of the hours the price has been zero or lower.

In 84 hours (20.6% of the total) negative prices were recorded (between €0 and €-1/MWh) and the average price between 11:00 and 17:00 hours was €-0.08/MWh. There were also another 117 hours (28.7%) with “zero” prices. Although the negative prices are symbolic, they reflect that there is such an excess of renewable supply that some generators prefer to produce rather than disconnect, to avoid the costs that this may entail.

Weather also lowers spot electricity prices in Europe

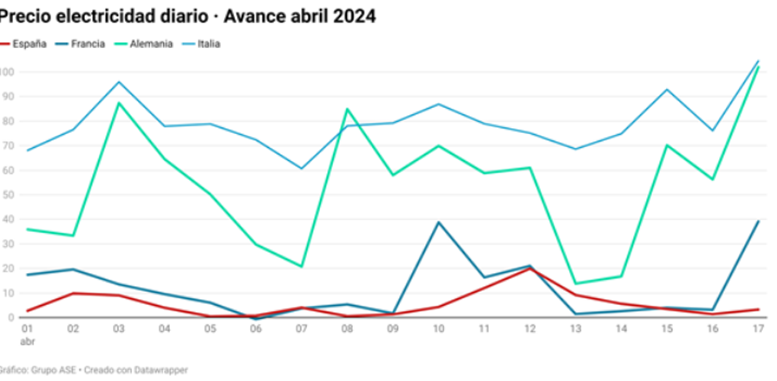

Despite the increase in the prices of the main commodities (gas, coal and CO2 emissions), the combination of low demand and very favourable weather conditions for wind and hydro has caused spot prices in the European electricity markets to fall across the board. In any case, much higher than on the mainland.

Germany recorded an average price of €53.73/MWh, Italy €79.15/MWh, the Netherlands €50.17/MWh and the United Kingdom €48.09/MWh. Only France, thanks to a surplus of hydro power and improved nuclear generation, comes close to Spain with a price of €11.92/MWh (double the Spanish price).

Spain shows a unique pattern compared to the rest of Europe, driven by solar generation and a high base load of nuclear power. In recent months, wind and hydro have experienced a strong increase, generating an oversupply that has not been able to absorb our limited interconnection capacity and has caused prices to collapse. At present, the key is hydro.

Hydropower leads the mix

Hydroelectric power has become the superstar this spring. The reservoirs of the Duero and Miño basins, where 60% of Spain’s hydroelectric capacity is concentrated (some 10,000 MW), are at 90% of their capacity, forcing them to release water and increase their production.

So far in April, hydroelectric generation has averaged 152 GWh per day and has led the generation mix with 23.3% of the total. Its production was 206% higher than in 2023 and 39% higher than its average for the last five years.

According to ASE Group analysts, this is an exceptional situation, which will come to an end with the arrival of summer. Hydroelectric production will return to the seasonal summer ranges, which are much lower than at present.