The Standard and Poor’s 500 Index’ excessive optimism

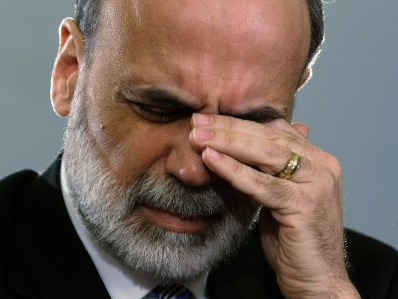

MADRID | At Barclays Spain, analysts have spotted an oddity. They say that in the United States market participants seem to discount two elements that appear to be contradictory: on one hand, that the Federal Reserve will keep its expanding monetary policy going on for the time being, something that Ben Bernanke would have made clear last Monday; and on the other hand, that the US economy will grow above expectations. “but the…