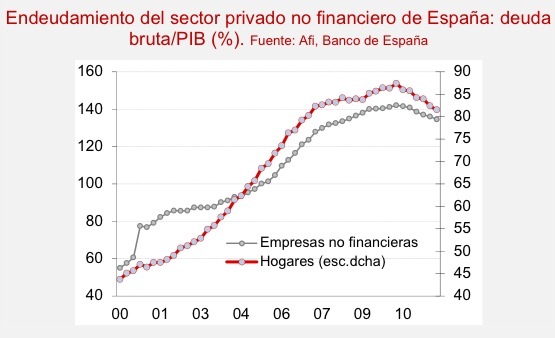

International Financial Analysts Afi brought to our attention this chart from 2011 financial accounts in Spain, which confirm that ratio of gross debt (loans and different security prices) of households and businesses in Spain has dropped by 13.5 percentage points of GDP. The figure is now 216pc, down from the maximum levels reached during the second quarter in 2010.

It also reflects the downturn in indebtedness operations during last year, with a negative balance of €45 billion and the biggest fall since the beginning of the credit crunch.

Here it is, then, indebtedness rate of non-financials private sector per GDP.

Be the first to comment on "Monday’s graph: improvement in gross debt ratio of Spain’s private sector"