By Luis Arroyo, in Madrid | Central bankers are incapable muppets covered with majestic pomp. The crisis has unveiled their naked, sad truth but what keeps them on their feet is that most people do not bother to properly scrutinise what they do and what they say. Crisis Maven is a blog devoted to analysing the words and actions of the Bank of England. It is a very curious case, that of the Bank of England and the English economy. The minutes of its monthly meetings lead me to wonder how, after years of failures and a change of national government, Mervin King has managed to save his head. Unbelievable!

I will excuse you for not reading BoE’s dense prose, but let’s have a look at the results. The BOE is required to pursue an inflation target of 2%, which is a goal imposed by the Treasury and which, therefore, could be set at any other level should the Treasury think otherwise. The BoE claims to pursue inflation expectations (Svensson model) …or shadows or ghosts, having seen the results.

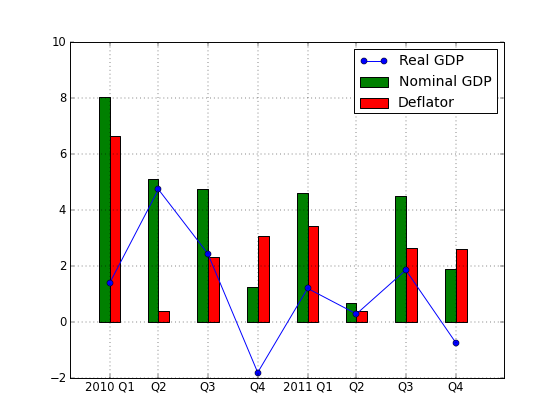

In this graph, the evolution of NGDP, GDP and deflator in 2010-2011: what do we see? Real GDP has shrunk while NGDP, although falling too, has done so in a way that price component is the only thing that grows, and real GDP contracts in Q4 2011.

Something is wrong when inflation rises steadily and GDP will not increase. The BoE has failed in its objective of price stability: inflation in the UK reached 5.2% in September 2011, and 4.2% in December. How does one justify this situation? Here’s what the minutes say:

Something is wrong when inflation rises steadily and GDP will not increase. The BoE has failed in its objective of price stability: inflation in the UK reached 5.2% in September 2011, and 4.2% in December. How does one justify this situation? Here’s what the minutes say:

“CPI inflation fell to 4.2% in December, down from 5.2% in September but still well above the 2% target. Inflation should continue to fall sharply at the start of 2012 as the impact of past rises in VAT and petrol prices drop out of the twelve-month comparison. Inflation is likely to decline further thereafter, as the upward pressure from external costs diminishes and spare capacity continues to weigh on wages and prices.”

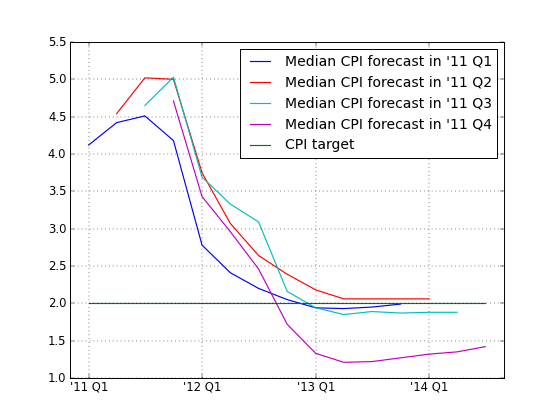

That is, it is external factors’ fault. And of course, keep calm and do not worry, because the BoE forecasts that inflation will return to 2% immediately…

These are the offered successive quarterly forecasts in its Inflation Report.

As you can see, going from Q1 to Q2 2011, the Q2 expectations must be dragged from 4.5% to 5%, a little unexpected jump, but who cares?! We are in a longer term and everything may change except the happy ending about the CPI blissfully being 2% or even less! always according to the Inflation Report forecast from Q4 2011.

As you can see, going from Q1 to Q2 2011, the Q2 expectations must be dragged from 4.5% to 5%, a little unexpected jump, but who cares?! We are in a longer term and everything may change except the happy ending about the CPI blissfully being 2% or even less! always according to the Inflation Report forecast from Q4 2011.

Had indeed the sole objective of the BoE been a stable inflation of 2%, a couple of years ago in the middle of the crisis, it would have restricted the money supply, which would have triggered chaos, probably. Now inflation is expected to drop to 1% by 2013, which would force it to do quite the opposite, which is what they are doing: £50 billion of Quantitative Easing. Whereupon inflation will rocket back to the moon.

The price-GDP ratio or the Phillips Curve in the UK is really strange. It is the only country that, after the crisis, has seen the highest inflation in the developed world alongside the weakest growth. That can only be due to structural factors (perhaps too many administered prices). But beware, the British labour market is the most flexible in the world, which demonstrates the futility of the Spanish labour reform in a moment like this.

It would make sense that the government authorised another target for the BoE, instead of allowing it to go chasing shadows it never catches. I wonder how much confidence Britons have in their central bank. Its reports are filled with elegant graphs, market expectations and open paths to subtle Fan Charts with risks on the way up and down… a mayhem that makes one marvel at the fact that the BoE staffers haven’t yet been all fired.

Since the BoE reform in 1997 introduced by Tony Blair and Gordon Brown, the BoE has been badly dodging the ghosts of the past. Twenty years later, it lives within a permanent nightmare.

Be the first to comment on "Why on Earth is Mervyn King still governor of the Bank of England?"