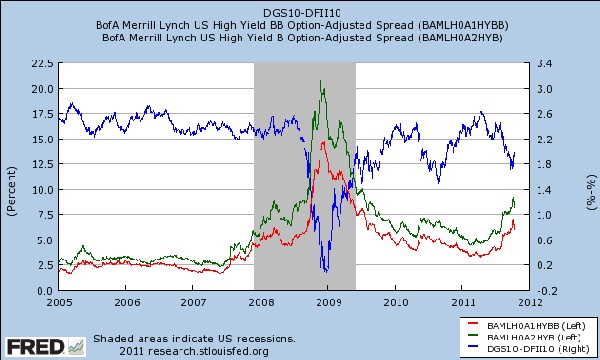

By Luis Arroyo, in Madrid | Look at the USA. In the graph above, left scale, the yields (spreads of Treasuries) of BB corporate bonds (red line), and B (green line). Right scale, blue line, inflationary expectations (type of bond at 10 years minus the same inflation protected). A functional relationship can be detected between the variations in inflation expectations and private bond yields. The higher the expected inflation, the lower the yields required of firms (compared with government bond), and vice-versa, as shown. Note the violent rise and fall in the recession area (in grey).

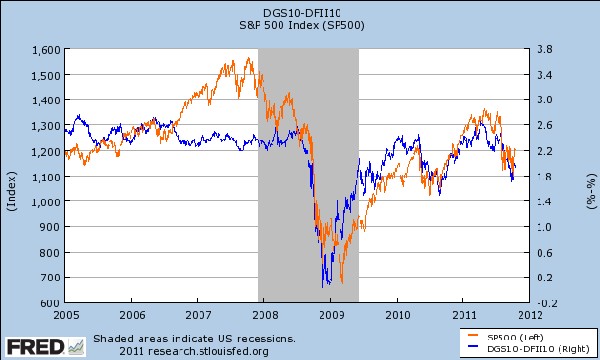

In the second graph, we can see that the same inflation expectations (blue, right scale) also appear to act on the exchange (red, left scale), and lower it when they deflate.

Conclusion: inflation expectations, in a particular context as in the current one of weakness and uncertainty, correlate positively with the prices of private assets.

This could be interpreted in the opposite direction, but it would be more complicated. The natural thing is to think that inflation expectations are linked to hig

her GDP expectations, and this reduces the risk premiums on assets that, unlike Treasury bonds, contain a considerable capital risk. As the appetite for risk increases, the interest in Treasury bonds most certainly evaporates.

The markets are sensitive to signs of inflation in a given context. Or, as David Glasner says: “Investors do not fear inflation, they yearn for it”, or even, “Markets love inflation” (here). It's nothing new. It's simply not considered relevant nowadays. It has been erased from the collective memory. Inflation is now the absolute evil, and real GDP is absolute good.

As Tim Bond says (quoted in Glasner):

“The underlying defect in QE is that it stirred investors’ fears of monetary inflation, whilst stimulating the wrong sort of inflation in the wrong places. The early positive economic effects were subsequently overwhelmed by a negative inflationary blowback that played a key role in disrupting the recovery.”

It’s a lie.

Dedicated with love to economists with cobwebs in their eyes which do not let them see the spider.

Luis Arroyo is a former Bank of Spain economist. He writes for www.consensodelmercado.com.

ha quedado espectacular