Sell-off in Eurozone sovereign bond markets likely to be temporary

Over the past two weeks, the sell-off in the Eurozone sovereign bond market has put yields back at or above their levels at the beginning of the year. This has triggered some upward pressure on EURUSD and a fall in European equity markets. In our view, the sell-off is likely to be temporary and we expect sovereign yields to come down as of June. In a way, this scenario is consistent with past QE programmes: sovereign bond markets experienced a temporary sell-off in the four months following the implementation of Fed QE and BoJ QE in 2013.

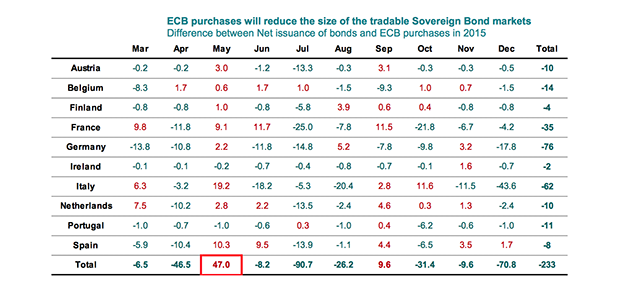

The main culprit: ECB QE is not shielding Eurozone bond markets in May

As we highlighted in our update Low oil, low yields, low inflation…for longer (20 April), net issuance of sovereign bonds will exceed ECB purchases in May by c.EUR50bn. We believe this is why yields are going up. We also believe this is why they will come down again from June, when ECB QE will again significantly outpace sovereign bond issuances (by c. EUR8bn in June and EUR90bn in July).

Other factors may contribute to keep yields around current levels

The rise in sovereign bond issuances coincided with a more hawkish than expected Fed meeting. This may have pushed global investors to take profit on sovereign bond markets. Moreover, the rise in oil prices has slightly lifted inflation prospects and inflation expectations. However, the weakness of the Eurozone labour market should prevent the rise in oil price feeding into wage increases. Bund underperformance may also be explained by lower risk aversion over diminished Grexit fears.

ECB QE will hammer yields in June and July

The current excess supply of sovereign bonds is transitory and ECB QE will further reduce the size of Eurozone sovereign bond markets. Moreover, the fall in government interest payments is already improving the sustainability of public debt. Such relatively high sovereign yield levels within the Eurozone may offer a buying opportunity for bond investors.

Be the first to comment on "ECB purchases will reduce the size of the tradable sovereign bond markets"