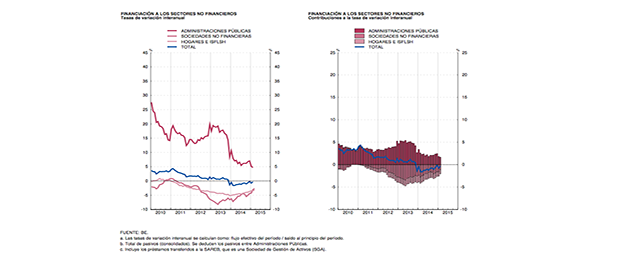

As you can see in the figure above, credit lending to the private sector in Spain is shrinking by 3% year-on-year, while lending to the public sector is up by 4.7% y-o-y.

So if someone wants to see a significant impact from Draghi’s QE, as a result of which €5 billion have been injected into the Spanish economy since March, that will require some effort. €5 billion is only 0.5% of Spain’s GDP. The US Federal Reserve, the Bank of England and even the Bank of Japan hold more than 25% of their goverments’ GDP in debt.

Be the first to comment on "Stronger credit lending in Spain… to the public sector"