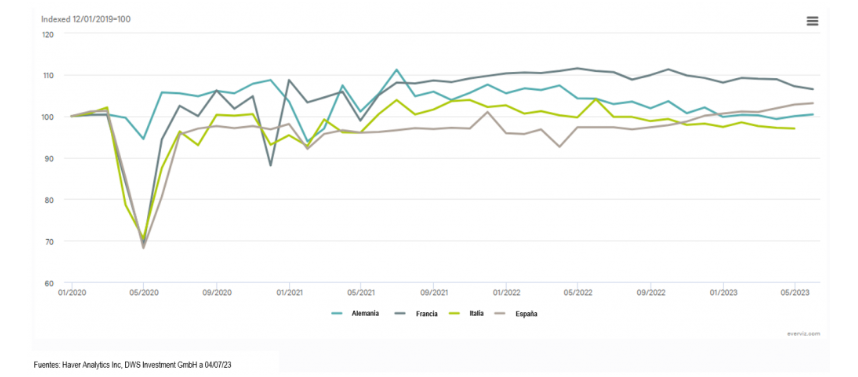

DWS| Zero percent. According to recently released data for May 2023, retail sales in Germany have grown by exactly 0% in real terms since the last month before the pandemic, February 2020. In nominal terms, by contrast, thanks to inflation, sales have grown considerably, by an impressive 17%. However, this is not a sign that consumers are buying more: the amount of goods they received remains unchanged. Despite this, it seems that this has not bothered the average German citizen too much. In 15 of the 42 years since 1980, retail sales have declined in real terms compared to the average of the previous year. Seen from this perspective, it is almost positive that retail sales in Germany are stabilising again, as our Chart of the Week shows.

This is even more evident when one considers how far consumer sales have fallen from their previous peaks during the pandemic years. The chart alone does not provide sufficient reason to say that the stabilisation in Germany will continue. However, we expect it will, for a very simple reason: while inflation, especially in goods, is already declining, many workers are just beginning to enjoy the wage increases agreed in recent months. This means that many of them should experience an increase in their real purchasing power in the coming months. Not only in Germany, but also in other parts of Europe.

The graph also shows how purchasing dynamics differ within Europe, either due to divergences in the severity of the downturns caused by Covid or in government support measures in the years that followed. Different economic structures might also have been a factor. Spain certainly combines both: it suffered disproportionately from the direct and indirect consequences of Covid because of the role of tourism in its economy, but is now also benefiting from Europeans’ renewed desire to travel. This momentum is reflected not only in the retail sector, but also in other consumer segments, especially services, where we continue to expect a stronger recovery than in retail. In Europe as a whole, private consumption should drive growth in the coming quarters.