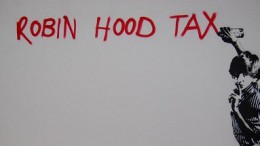

José Sartorius: “Most Spanish employers understand UK’s ‘no’ to the Tobin Tax”

By Jacobo de Regoyos, in Brussels | José Sartorius Álvarez de Bohorques devotes most of his time to his role as a member of the European Economic and Social Committee. He was appointed by the Spanish Confederation of Employers’ Organizations CEOE and the Banking Association AEB. Are the Spanish entrepreneurs against the Tobin tax? Well, I have not met with all Spanish entrepreneurs, but the AEB and the CEOE are contrary to the Tobin…