Two Spanish supersector leaders, as Dow Jones and Sam call them, made it into this year’s Dow Jones Sustainability Index: they are Enagas and Repsol. If you have not heard about this list until now, here is a briefing:

Launched in 1999, the DJSI are the first global indexes tracking the financial performance of the leading sustainability-driven companies worldwide. Today, the index family has approximately USD 8 billion in assets under management in a variety of financial products including mutual funds, separate accounts, notes and exchange-traded funds (ETFs). With approximately 60 licenses, the DJSI have been linked to financial products in 16 countries, an indication of investors’ increasing appetite to utilize the index as a means to reflect their sustainability convictions within their portfolios

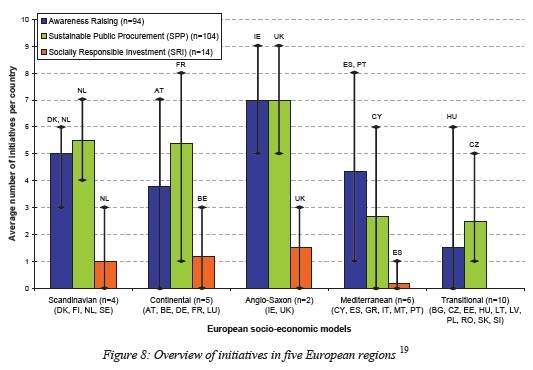

In spite of the majority of entries in the DJSI being European, the truth is that the Mediterranean-based (peripheral?) corporations don’t fly high in the ranking. Awareness, though, already showed a healthy trend back in 2008, so it is safe to say that keeping the flame after a three-year-so-far severe economic downturn sounds like good news.

The data was collected by the European Commission, by the way.

So it is right that former savings bank-shaped CaixaBank congratulates itself, too, for maintaining its appearance in the DJSI next to other 342 companies from all over the world. CaixaBank,

“the leader in retail banking in Spain and with a solid commitment to growth both domestically and internationally, thanks to its proven experience in investments in the banking sector and the prudence that characterises it,”

surely deserves credit for it.

Be the first to comment on "CaixaBank adds to Spain's flame for socially responsible investing"