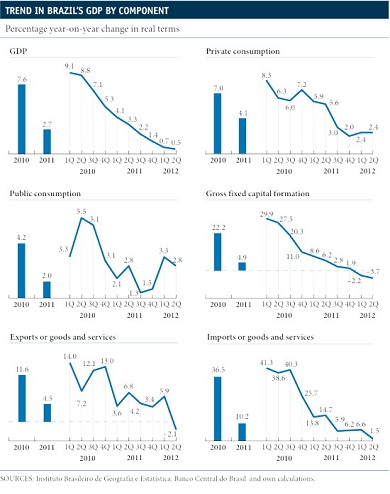

Growth figures for the second quarter were again disappointing, up by 0.4% on the previous quarter, which in year-on-year terms represents meagre growth of 0.5%. By component, the main contribution came from consumption and inventories. After more than a year with the tap of stimuli open, Brazil's desired upswing in economic growth is therefore still postponed, at least for another quarter.

Macroeconomic indicators point to the third quarter being better than the first and second together: industrial production has seen two consecutive months of month-on-month growth in June and July, after successive declines between March and May; retail sales rose again in June after falling in May and the index of economic activity, which approximates the monthly growth in real GDP, increased again in June and July after remaining practically unchanged in May.

Moreover, the bulk of the evidence available suggests that the rate of activity will have accelerated in August. This scenario supports our forecast of quarter-on-quarter growth of around 1% in the third quarter of the year and of growth for the year as a whole at around 1.5%.

However, just in case, and anxious to see activity speed up, the Brazilian authorities keep underpinning the economy with new levers, now complementing expansionary macroeconomic policies with measures to boost its growth potential, such as a new infrastructure plan.

In its efforts to relaunch domestic spending, as foreign demand will remain weak, Brazil's central bank therefore reduced the SELIC rate by a further 50 basis points in August, leaving it at another record low of 7.5%. Moreover, it can be inferred that, if not enough improvement is seen, we might even see a further reduction in October, albeit possibly a smaller one, as we don't expect the official rate to fall below 7.25%.

On the other hand, Brazil's highest monetary authority also decided, by surprise, to reduce reserve requirements in order to boost credit. In the fiscal area, the stimuli already in place were reinforced in August with an extension of VAT exemptions on durables, up to the end of 2012, and on capital goods, up to the end of 2013, as well as speeding up the schedule for the depreciation of capital goods (from 48 to 12 months).

Within a scenario in which tensions in Europe are tending to moderate and the global situation is stabilizing, most of these stimuli should start to have an effect on activity over the coming months. On the other hand, actions on the supply side will take longer to produce an effect, as well as there being still a long way to go in terms of structural reforms to make the economic system of the leading economy in Latin America more flexible.

The pressure on prices is therefore expected to increase from now on and throughout 2013 and it might return dangerously close to the target of 4.5% ± 2% by the end of next year. This has led us to anticipate another shift in monetary policy in the second half of 2013 although, before raising interest rates, the macroprudential stimuli implemented during the previous year will be withdrawn.