Family-controlled publicly traded companies have consistently outperformed

Markets seem to have under-priced both the growth and risk associated with public companies that have founding families as major shareholders. Our proprietary analysis suggests that family-owned small and midcaps have consistently outperformed their respective indices for the past decade – returning, for instance, 104% in the last five years, vs. 53% for largecaps and 69% for midcaps, with lower volatility.

Disciplined governance is king and queen

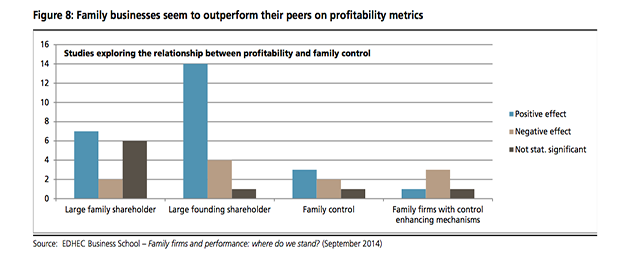

Floated family-owned businesses have, by and large, passed the perils of the initial founding phase. Evidence shows that companies at this point in their life-cycle usually combine the benefits of funding via capital markets with a focus on core business, less value-destructive M&A, and more effective general governance. The positives of family ‘skin in the game’ have historically outweighed any potential negatives, and this outperformance window tends to stay open as long as the family ownership persists.

We designed a proprietary framework to assess governance and risks

Based on governance areas that we believe drive outperformance (such as transparency, board succession, shareholder rights and remuneration), our analysts ranked close to 250 family-owned small and midcap companies globally to identify those with the best corporate governance. This global balanced index of 250 family- owned stocks has outperformed a global midcap index over 1, 3, 5 and 10 years.

Our list of the 20 best global stocks that fit this theme

Our analysis identified 20 stocks in the US, Europe, Asia and LatAm that fit this theme. In the US, our top picks include Fortinet and Installed Building Products; in Europe, Eurazeo, Ebro Foods and GBL; in Asia, Top Glove and RiseSun Real Estate Development; in Japan, Daiichikosho, Seria and CyberAgent; and in LatAm, Fibra Danhos and Iochpe- Maxion. Please see page 5 for a full list.

Be the first to comment on "Corporate governance: Why do family-controlled public companies outperform?"