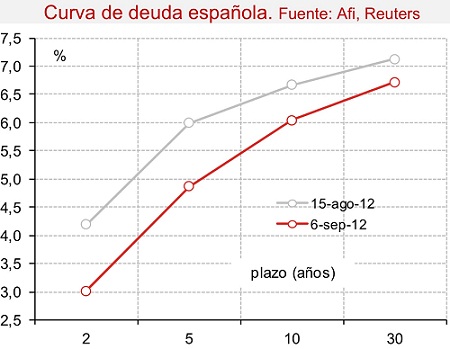

LONDON/MADRID | President Mariano Rajoy should manage to take this week a breath, although it will probably feel too weak. A simple look at the curve of Spain’s government debt now shows a steep upward gap between the internal rate of return of two-year bonds and the cost of the medium and long-term credit for the country. Indeed, 24-month debt paper’s IRR has tightened by more than 450 basic points comparing to the last weeks in July.

The reason is, of course, the announcement of unlimited purchases of short-term sovereign bonds the European Central Bank recently promised. The measure is set to provide urgently needed liquidity to States whose economies are vital for the survival of the common currency and currently suffer the markets’ loss of confidence, namely Italy and Spain. But they will have to officially ask the European rescue funds for help.

Analysts at Afi in Madrid said that, since 2007, the IRR on five, 10 and 30-year Spanish bonds is at its highest when put in contrast to the short-term debt’s. And here is the challenge for the Spanish Treasury: to extend the reduction of costs to longer-term paper and regain investors’ demand.

“Spain must prove it can rebalance its finances to stop capital fleeing its economy, stimulate investors returning to the country and maintain its access to the markets,” Afi experts reminded Madrid.

If only the Spanish cabinet could come up with swift reforms to ensure the change, the ECB’s words would be enough.

Be the first to comment on "What an unfortunately insufficient difference an ECB word makes"