ING | The ECB is weighing sticky inflation and wages with a softening growth outlook, French political turmoil, and more dovish Fed expectations. Cutting again this week is out of the question, and giving new rate guidance is probably an undesirable path too. Once again, less is more in ECB communication, and the impact on rates and FX should be limited

As discussed in our full European Central Bank preview, we think the Governing Council will avoid disrupting markets with any new forward guidance at its 18 July meeting. There is an inevitable spillover effect from the recent dovish repricing in Federal Reserve expectations and the turmoil in French bond markets; incidentally, the recovery in growth expectations is losing steam. At the same time, inflation has failed to ease convincingly, and there are lingering concerns about wage growth stickiness.

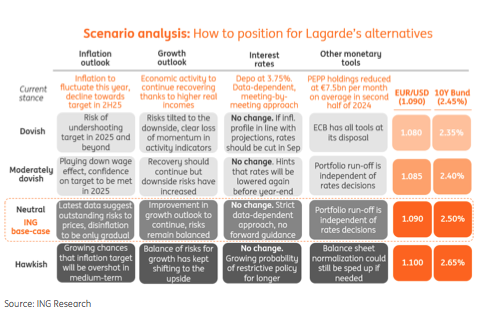

Off-meeting ECB communication has indicated that rates will most likely be kept on hold at this meeting, and in our scenario analysis above we excluded a surprise rate cut. Some members have endorsed the recent pricing for two more cuts this year, and considering recent non-data developments and the reputational risks of a hawkish turn one meeting after a rate cut, a cautious tone and lack of forward guidance seems the most reasonable (and likely) choice for the central

EUR rates to remain driven by US data

Markets currently see very little chance of anything happening at this meeting, but attach a probability of more than 80% to a second ECB cut in September following June’s move. A third cut is fully priced by January. There had been a subtle trend in expectations towards fewer cuts as some key ECB members – including Chief Economist Philip Lane – indicated that sticky services inflation remained a concern, but this turned again with the pieces falling into place for Fed rate cuts and US rates also dragging EUR rates lower again.

But the ECB council is less clear, and more divided views have meant that EUR rates have lagged versus US rates. The spread between two-year US and EUR OIS rates has compressed to its tightest levels since January. We do not think that this Thursday’s press conference will provide more clarity on the ECB’s outlook. The central bank might take care not to repeat the mistake of committing to a cut too far ahead, and the main goal this time around should be not to disrupt markets – reflecting ECB member Klaas Knot’s remarks that he was “fine” with market expectations.

Despite all assertions that the central bank is independent from the Fed, for lack of guidance EUR rates should remain more driven by the US data near term as we think markets have seen a crucial turning point, tilting towards more decisive Fed cuts.

The euro still lacks a compelling domestic story

Markets have turned a blind eye on the French political gridlock, which has allowed EUR/USD to rise in line with more dovish Fed rate expectations. We are observing some USD buying across the board as markets seemingly raised their bets on a Trump re-election following Saturday’s assassination attempt. The main consequence is lower liquidity in the FX market, which is not as worrying for the highly liquid euro as it is for commodity, high-beta currencies.

Still, unless US election pre-emptive positioning becomes the dominant FX driver this summer (we have our doubts), fundamentals and domestic political/central bank developments will remain a key factor in determining sensitivity to any new data-driven USD declines. We still think the euro lacks a strong domestic story to justify its outperformance against most G10 peers, also given the dormant risk of French fiscal concerns coming back to weigh on the common currency.

We doubt the ECB will provide any long-lived boost to the euro either, as we see the Governing Council deliberately refraining from interfering with market pricing. There are some modest upside risks for the euro in the very near term, as some degree of acknowledgement for the slower inflation decline may offer some support. Once again, we don’t think that should last, and EUR/USD may slip back to 1.0800 in the next couple of weeks as the dollar regains momentum and given the lack of EUR-specific positives.